The 3 Systems You Need to Scale to $20 Million

Growth without structure is chaos. Profit without discipline is fragility. And founder-led operations without transferability is a ceiling. If you want a business that can grow to $20 million in revenue and give you options—more momentum, more control, more freedom—you need three systems working together: a Growth Engine, a Cash Flow Waterfall, and a Scalable Operating System.

Why three systems?

Scaling is not about a single hack. It is about making three things predictable and repeatable:

- Leveraged sales—predictable, repeatable revenue that does not reset to zero every month.

- Bankable profit—real cash in the bank you can distribute or reinvest, not just P&L paper profits.

- Transferable value—the ability to move value creation out of the founder's head and hands and into people and systems so the company can run without the founder as a bottleneck.

When those three things are in place you get momentum, scale, and options. Momentum lets you keep fueling growth. Transferable value removes the founder as the rate-limiting step. Bankable profit gives you the freedom to raise money, sell, or remain independent. The challenge for many businesses around the $2 million mark is that they need the roles that deliver these outcomes—the CMO/CRO, CFO, and COO—but they can’t yet afford full-time executives at market rates.

How to solve the affordability gap

The practical answer is to build systems that either replace, augment, or support the people who would normally do that work. Systems let you get the outcomes without paying the full price of hiring seasoned executives immediately. You can build and install these systems in under 90 days if you focus and follow a disciplined cadence.

System 1: The Growth Engine

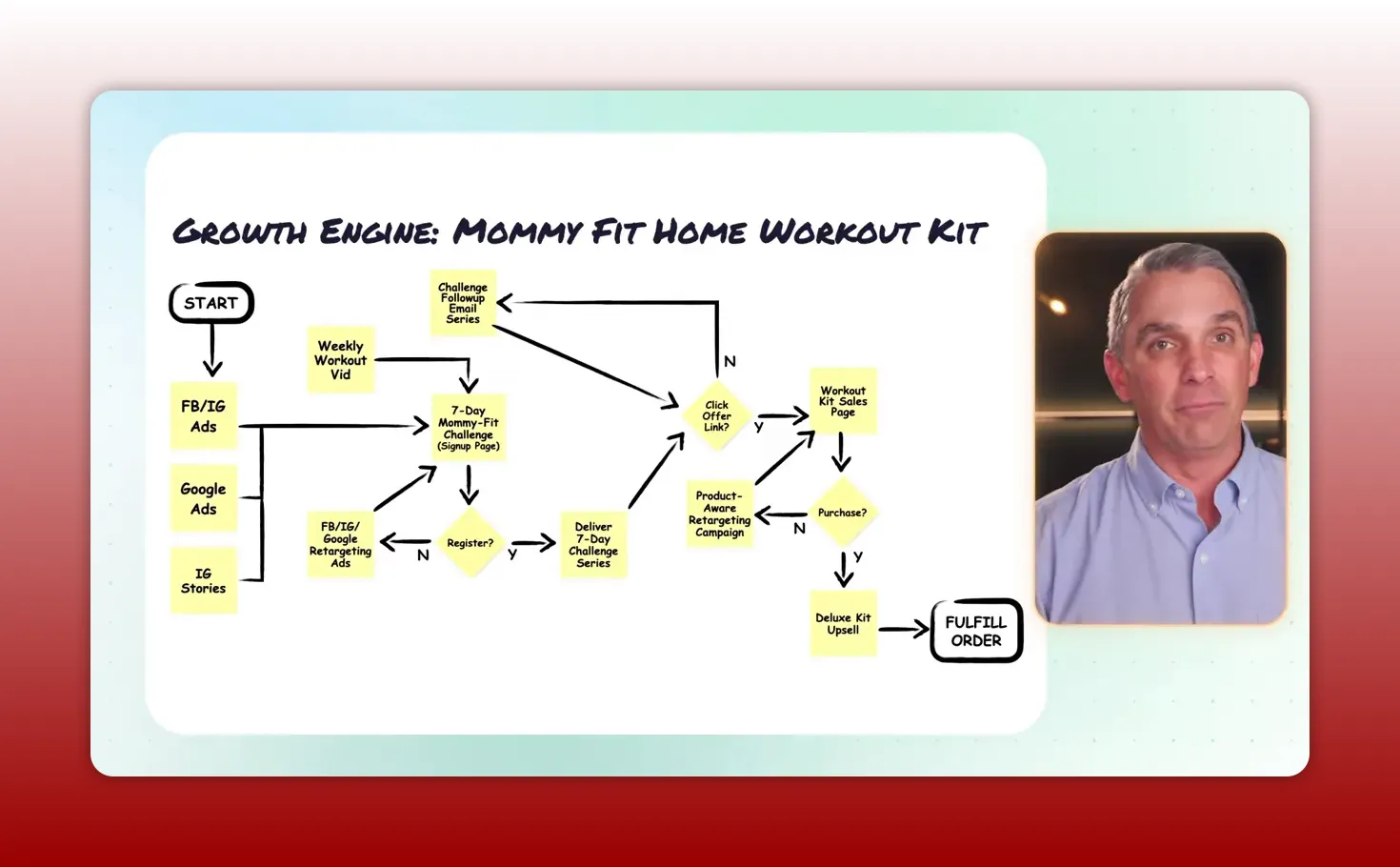

A Growth Engine is a proven process that generates an increasing flow of new leads and customers from scratch, largely on autopilot. Its job is to answer one simple question with clarity: How do customers happen?

If you cannot visualize the customer journey—every step from first contact to conversion—you cannot optimize it. Without visualization you will chase shiny tactics and waste budget on fixes that do not address the real bottlenecks.

Map your Growth Engine with sticky notes

Start with a whiteboard or a large sheet of paper and small sticky notes. Top-left represents how prospects find you; bottom-right is the product or offer they ultimately buy. Then connect the dots. Clicks. Landing pages. Email sequences. Consult calls. Demos. Purchases.

Visual mapping forces you to document what actually happens rather than what you wish happened. The first map will be rough and incomplete. That is okay. The objective is to make the process visible.

Examples that scale

A direct-to-consumer example might look like meta ads and reels driving to an email opt-in challenge, followed by nurturing and a high-converting sales funnel. A software-and-consulting business might use meta ads to drive signups for a webinar. Brick-and-mortar businesses can map the same customer journey—ads or local search to phone calls, to appointment reminders, to service delivery.

The form differs but the mechanics are the same: attract, engage, convert, then deliver. Once you map the growth engine, you are ready to measure.

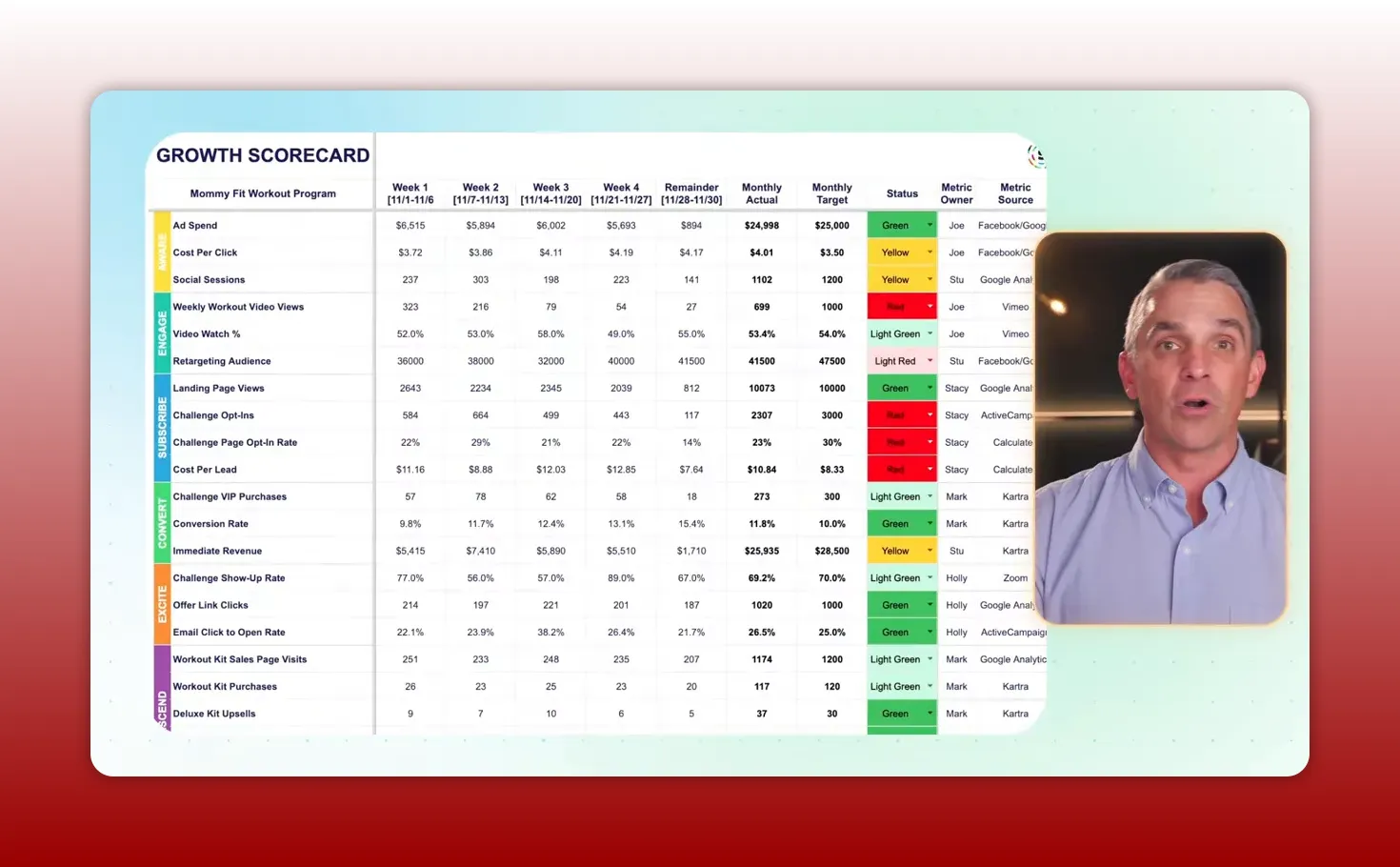

Build a Growth Scorecard

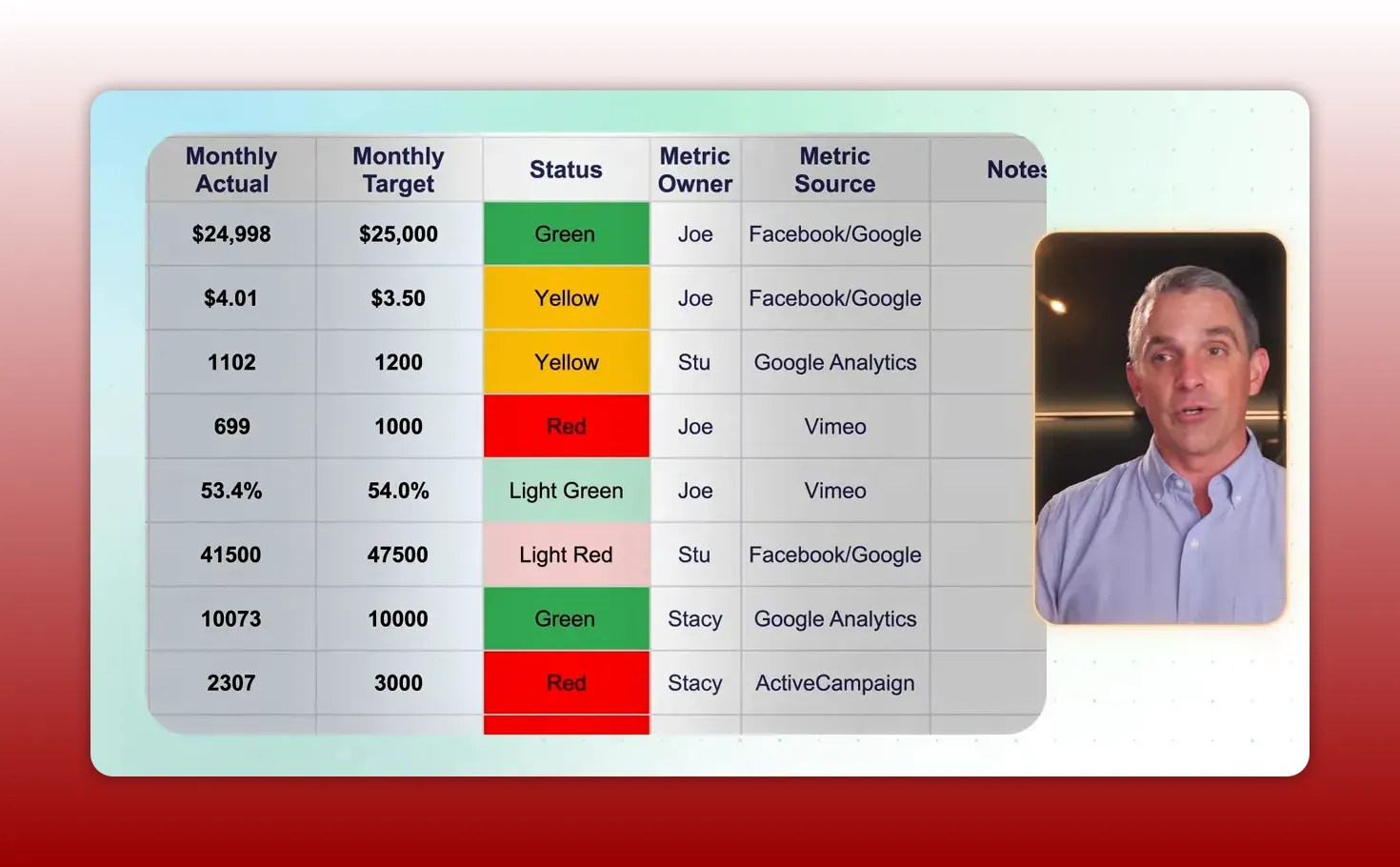

For every sticky note in the growth map, define the metric that proves that stage is working. Read the map left to right; read the scorecard top to bottom. If your map shows Facebook ads feeding a landing page, the corresponding scorecard rows might be ad spend, cost per click, landing page conversion rate, and email opt-in rate.

Set targets and use a color-coded system: green = at target, yellow = behind but with a plan, red = behind and in need of immediate attention. The visual parity between map and scorecard makes clear where the bottleneck sits. When a metric turns red you know exactly which stage to optimize.

A practical 90-day growth plan

- Week 1: Map the Growth Engine end to end with the team.

- Week 2: Define the scorecard metrics and set targets for the quarter.

- Weeks 3–6: Run one or two experimental projects aimed specifically at the red metrics.

- Weeks 7–12: Measure, refine, and repeat. Lock in the changes that turn red to green.

Repeat this cadence every quarter. The Growth Engine becomes an engine rather than a campaign. Over time you will move from chaotic acquisition to consistent, leveraged growth.

System 2: The Cash Flow Waterfall

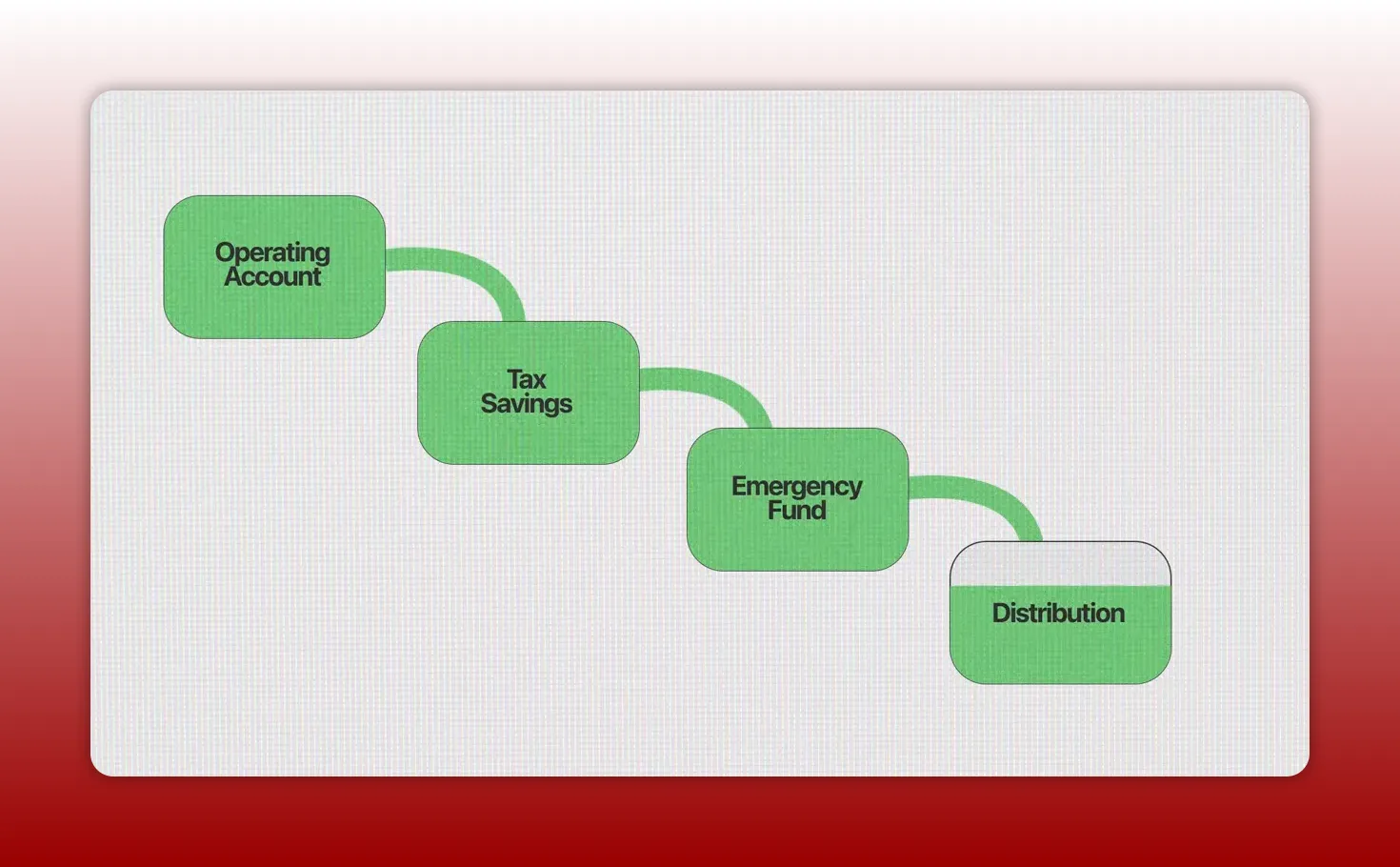

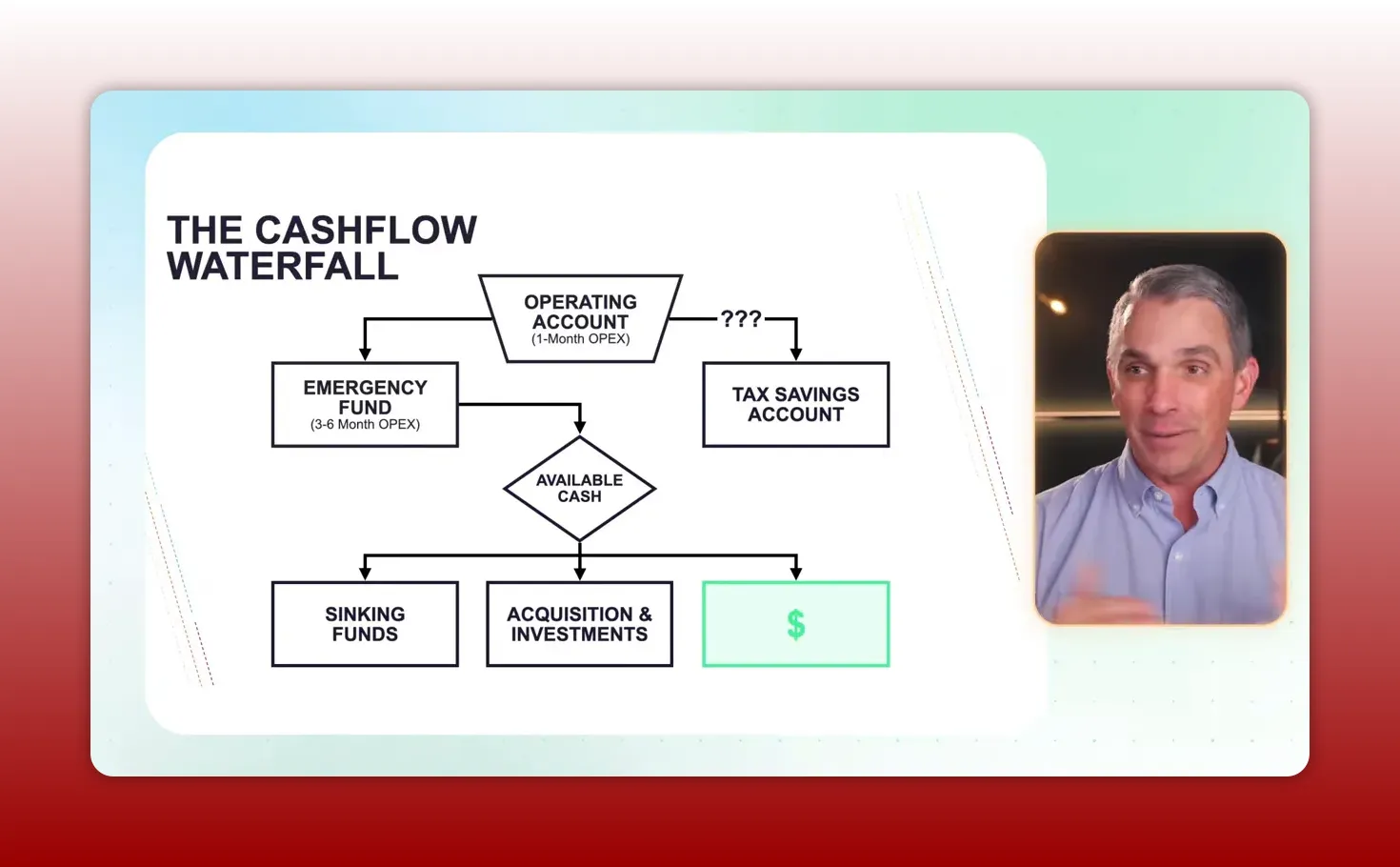

You can be profitable on paper and still go bankrupt. P&Ls can be misleading. Cash does not lie. The Cash Flow Waterfall is a simple account structure and cash management policy that ensures profits become bankable and distributable.

The principle is straightforward: sweep available cash from the operating account into prioritized specialized accounts for predetermined uses.

Account structure and priorities

- Operating account: Keep one month of operating expenses. This is the minimum float to run the business.

- Tax savings account: The government gets paid first. Never play roulette with payroll and tax liabilities.

- Emergency fund: Build this to cover three months of fixed operating expenses. This is insurance against unexpected revenue drops or cost shocks.

- Sinking funds / special purpose accounts: For anticipated capital projects, acquisitions, equipment replacement, or large events.

- Distribution account: Excess cash flows here and should grow month over month.

At month-end, sweep any cash above one month of OPEX out of the operating account and into the tax and emergency buckets first. Anything left moves into sinking funds or the distribution account.

Distribution discipline

For portfolio companies, a practical discipline is to distribute 80 percent of what sits in the distribution account at quarter-end and keep 20 percent as a reserve until year-end, when the rest can be distributed. If the business needs reinvestment, distribute the funds and then make a deliberate decision to put them back in. Money that leaves the company sharpens the investment decision-making process.

Paying the team and the founders well is not selfish; it is a sign of efficiency and a healthy enterprise. Business owners who sneak away profits often hide underlying operational problems. The distribution account should be growing. If it is not, you need to find inefficiencies or re-evaluate pricing, margins, or cost structure.

How a Cash Flow Waterfall supports scale

The Cash Flow Waterfall converts accounting profit into deployable cash. That cash is the fuel for hiring, buying growth, making acquisitions, or returning capital. When you can prove month-over-month growth in the distribution account, you have the hard evidence of a scalable, profitable engine.

System 3: The Scalable Operating System

The Scalable Operating System is the company’s single source of truth. It documents what the company does, how it does it, and the progress it is making toward goals.

Every business has an operating system. In early stages it is the founder. The founder is the living operating system. That works while the business is small. As the company grows, the founder-as-OS becomes the bottleneck. Upgrading your operating system is the most important step to move from $2 million to $20 million.

Value engine mapping: growth, fulfillment, innovation

The operating system starts by systemizing execution with value engine maps. There are three types of value engines:

- Growth engine: How customers are attracted and converted.

- Fulfillment engine: How the company delivers value and services customers post-sale.

- Innovation engine: How products and offers are created and improved.

Ask whether your business is demand constrained (you need more sales) or supply constrained (you cannot fulfill the customers you already have). Start with the engine that addresses your primary constraint. If you are demand constrained, focus on the Growth Engine. If you are supply constrained, map the Fulfillment Engine first.

Assign roles and critical accountabilities

Once you have value engines mapped, do an accountability audit. Go sticky note by sticky note and ask: who should be doing this step? Assign a person and then give each assignment a few clear critical accountability bullets. These will be the non-negotiable responsibilities that a person owns.

Expect uneven distribution at first. Some team members will have many bullets; others will have few. The tactical path to founder freedom is to move each sticky note away from the founder until zero critical bullets are attached to the founder’s name. Freedom is a checklist item: no more owner-specific tasks remain.

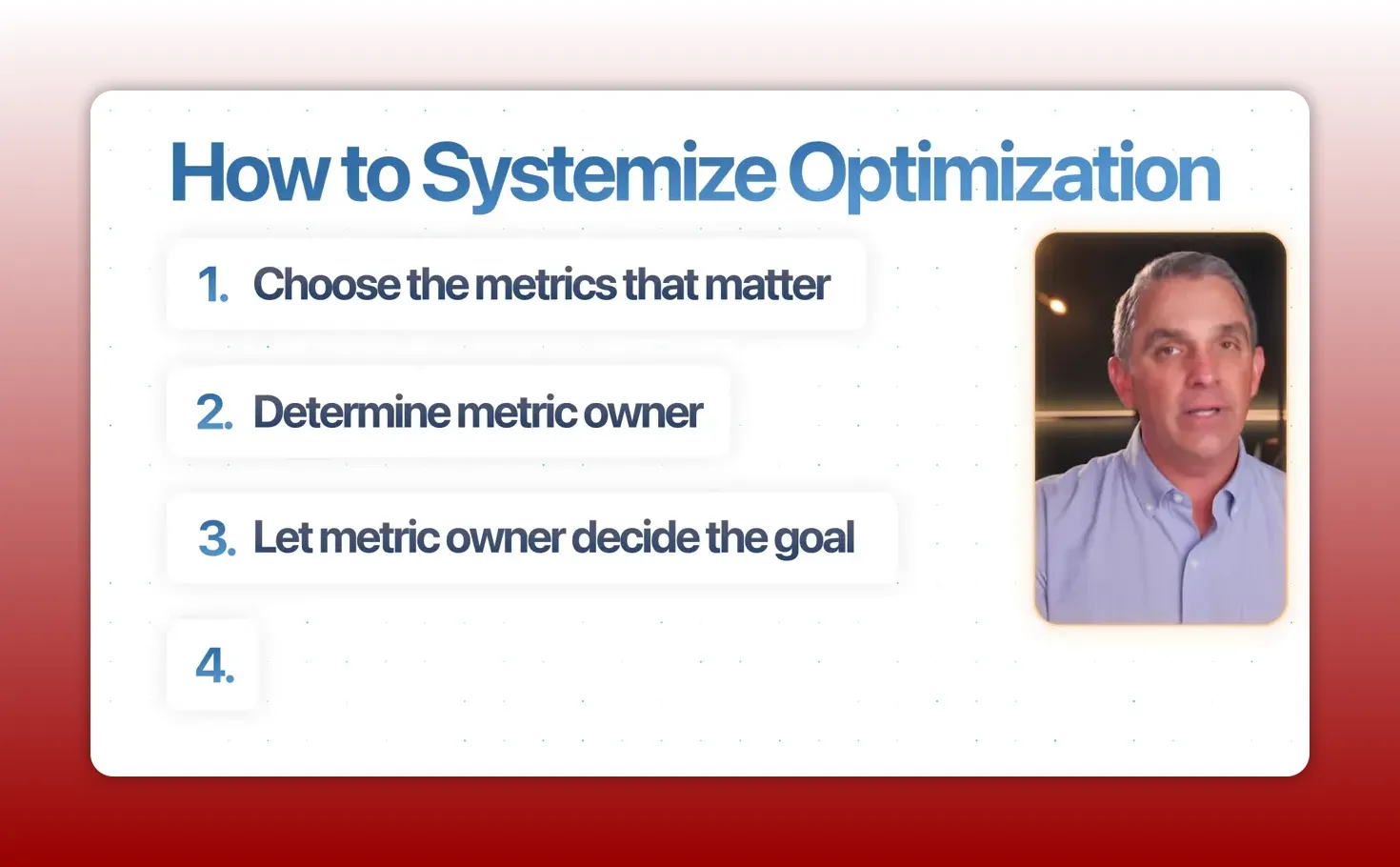

Systemize optimization with scorecards and dashboards

Transition your team from task-doers to outcome owners by building scorecards and dashboards that match your value engines. Choose the metrics that matter and then assign ownership to a named person. Every metric should have an owner and a target. If everyone is responsible, no one is responsible.

Have your team enter numbers manually on a weekly basis and mark each metric red, yellow, or green. Manual entry creates ownership and insight. If a metric is yellow, the owner should bring a plan. If a metric is red, you need immediate corrective action. Weekly manual input keeps your team aligned and engaged with the numbers.

Systemize decision making with a Clarity Compass

High-level decisions should not bounce to the founder for every case. Capture the company’s directional framework in a Clarity Compass that includes:

- Three-year target

- Company purpose

- Core values

- Strategic anchors

This framework helps teams make consistent decisions across company case, customer case, culture case, and competitive case. Use the Clarity Compass during quarterly offsites and reinforce it during weekly scorecard meetings so teams learn to make decisions in alignment with the long-term direction.

Quarterly sprints and the 12Q planning canvas

Use a simple quarterly sprint canvas to set the 90-day focus. Pick the big goal for the quarter, the three key North Star metrics, the three red metrics you must turn green, and the projects you believe will move those metrics. Pair that with a 12Q planning canvas to set short- and long-term revenue and profit targets.

Package value engines, playbooks, accountability charts, and scorecards into a single, accessible operating system dashboard. When everything lives in one place, the company lives outside the founder’s head and runs on documented processes and measurable outcomes.

Installing all three systems in 90 days: a practical roadmap

It is possible to install a minimal viable version of these three systems quickly if you prioritize mapping, measurement, and discipline over perfection.

Phase 1: Weeks 1–4 — Visualize and measure

- Week 1: Gather the core team and map your Growth Engine end to end with sticky notes.

- Week 2: Build a growth scorecard and assign metric owners. Create one month OPEX operating account rule.

- Week 3: Map the Fulfillment Engine (what happens after the sale). Create the basic cash flow account structure.

- Week 4: Run a weekly scorecard meeting and require manual metric entry. Sweep excess cash into the tax and emergency buckets for month-end.

Phase 2: Weeks 5–8 — Execute and optimize

- Run a single 90-day growth experiment aimed at the most critical red metric.

- Start weekly cadence: team fills scorecard, marks RYG, and presents plans for any yellow or red metrics.

- Implement tax and emergency savings transfers. Seed the distribution account with any excess quarter-to-date cash.

- Create the first set of playbooks for repetitive fulfillment tasks and move two sticky notes away from the founder.

Phase 3: Weeks 9–12 — Solidify and institutionalize

- Host an executive offsite to build the Clarity Compass: three-year target, purpose, core values, and strategic anchors.

- Publish the operating system dashboard with playbooks, accountability charts, and the scorecard.

- Run quarterly sprint planning with a 12Q canvas; set the next quarter’s big goal and projects.

- Distribute 80 percent of the distribution account at quarter-end if the company is healthy and reserves are intact.

After 90 days you will not have a perfect system. You will have a functional engine that can be iterated on. That engine creates leverage and lets you decide whether to hire, raise, or sell from a position of strength.

What changes when systems replace founder crutches

The most profound change is cultural. When the operating system becomes the single source of truth, people stop asking the founder for permission and start owning outcomes. Meetings become brief check-ins focused on exceptions and decisions. Hiring decisions are made against concrete metrics: will this hire move a red metric to green?

Management shifts from firefighting to coaching and portfolio-level decision making. Projects are prioritized by their expected impact on the scorecard. Capital allocation becomes deliberate because cash is visible and parceled into purpose-driven buckets.

Good people do not fix broken systems. Broken systems break good people.

Common pitfalls and how to avoid them

- Documenting what should be instead of what is: Start with reality. Map current processes first. Optimization comes later.

- Too many metrics: Focus on a handful of leading indicators. Excess metrics dilute accountability.

- Hands-off too fast: Systems need early-stage human supervision. Turn ownership over one sticky note at a time.

- Ignoring cash discipline: Treat tax and emergency funds as non-negotiable. Cash discipline protects your optionality.

- Expecting instant perfection: Systems evolve. The objective is consistent improvement and measurable outcomes.

Hiring after systems

One of the virtues of systems is that they let you hire deliberately. Instead of paying for an expensive generalist executive to fix everything at once, hire or outsource people to run defined systems and own named metrics. The question for every hire becomes: will this person move a red metric to green?

The hiring decision framework simplifies compensation and performance conversations. Hire slowly, measure quickly, and hold people accountable to the metrics in the operating system.

Tools and templates you need

- Whiteboards or digital equivalents for value engine mapping.

- Simple Google Sheets scorecards for weekly manual entry and RYG statuses.

- A bank structure that supports multiple internal accounts or sub-accounts for tax, emergency, sinking funds, and distributions.

- A shared operating system dashboard (a single folder or page that houses playbooks, accountability charts, scorecards, and planning canvases).

- Quarterly sprint and 12Q planning canvases for goal-setting and tracking.

Measurement cadence

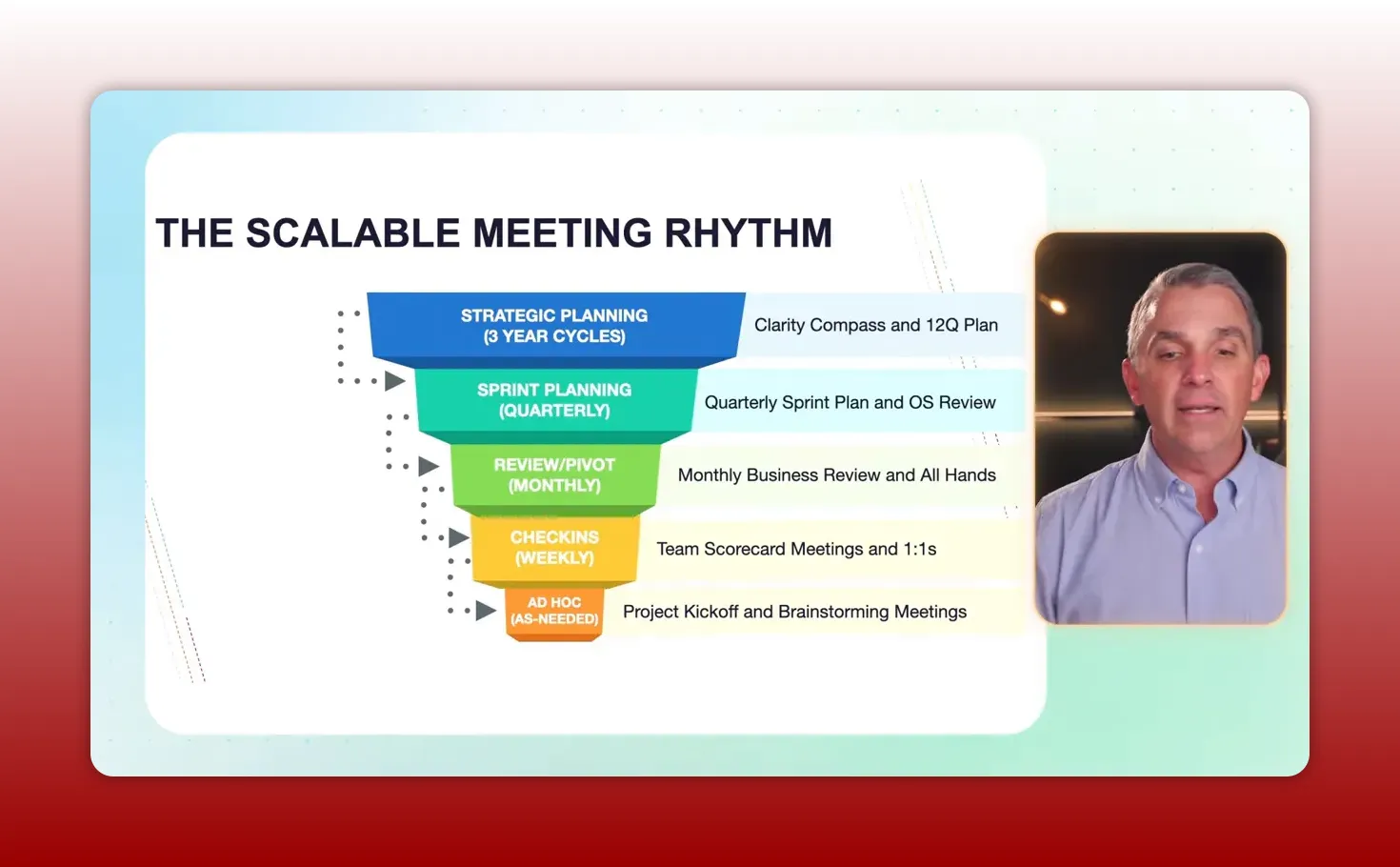

Rhythm matters. Here is a simple cadence that works:

- Daily: light monitoring of critical leading indicators if necessary (ads, bookings).

- Weekly: team fills scorecard on Monday morning and reviews RYG statuses in a 60-minute meeting.

- Quarterly: offsite to set the Clarity Compass and select the sprint goals for the next 90 days.

- Annual: review the three-year target and adjust strategy and resource allocation.

What to expect after implementing the three systems

Expect less noise, better decisions, and better allocation of capital and time. You will be able to answer objectively whether the business should hire, invest in a project, raise capital, or pursue an acquisition. Most importantly, you will build a company that produces bankable profit and has value creation that is transferable, inside and outside the organization.

That combination creates not just revenue but freedom. You will have the option to scale faster, to sell if it makes sense, or to step out of day-to-day operations without destroying value.

How do I know whether to start with the Growth Engine or the Fulfillment Engine?

Identify whether you are demand constrained or supply constrained. If you are constantly short of leads and wish for more customers, start with the Growth Engine. If you are overwhelmed and cannot fulfill the customers you already have, start with the Fulfillment Engine. Map whichever engine addresses your primary bottleneck first.

What metrics should be on my weekly scorecard?

Focus on leading indicators that directly reflect each stage of your value engine. For growth this might include ad spend, cost per click, landing page conversion, and lead-to-demo rate. For fulfillment consider lead response time, onboarding completion rates, churn, and net promoter score. Choose 8 to 12 core metrics that trace the customer journey end to end and assign an owner for each.

How much cash should I keep in the operating account?

Keep one month of operating expenses in the operating account as float. At month-end sweep anything above that into the tax savings and emergency accounts first, then into sinking funds or the distribution account. The emergency fund target is typically three months of fixed operating expenses.

What if I cannot afford to hire a CMO, CFO, or COO?

Build systems that replicate the essential functions of those roles first. A Growth Engine plus a scorecard can deliver what a full-time CMO would. A Cash Flow Waterfall and disciplined financial processes will cover many CFO responsibilities. A Scalable Operating System that documents value creation and accountability will deliver much of a COO’s work. Hire later to run these systems once they are proven.

How strict should I be with distributions?

Be deliberate. Distribute 80 percent of the quarterly distribution account and keep 20 percent until year-end as a buffer. If the business needs reinvestment, distribute first and then make a conscious decision to return capital to the company. Distributions force rigorous prioritization and better capital allocation decisions.

What is the single best thing to do right now?

Map how customers actually happen using sticky notes. The act of mapping reveals assumptions, highlights missing steps, and gives you the focus needed to build a scorecard. From there you can take small, measurable actions that compound into predictable growth.

Final checklist before you start

- Create a blank growth map on a whiteboard and schedule a team mapping session.

- Open a separate tax savings and emergency fund account; automate monthly transfers once you have one month OPEX covered.

- Set up a simple weekly scorecard in a shared Google Sheet and require manual weekly entries.

- Run a 90-day sprint focused on one or two red metrics and assign owners to each project.

- Document two to three repeatable playbooks for fulfillment tasks and move those responsibilities off the founder’s plate.

Systems are not sexy, but they are the engine of durable scale. Build the Growth Engine to make customers predictable. Build the Cash Flow Waterfall to make profit bankable. Build the Scalable Operating System to make value transferable. Then hire the people to run the systems. Good people do not fix broken systems. Broken systems break good people.

This article was created from the video The 3 Systems You Need to Scale to $20 Million.